ESG/Responsible Investment

The Fundamental approach to ESG

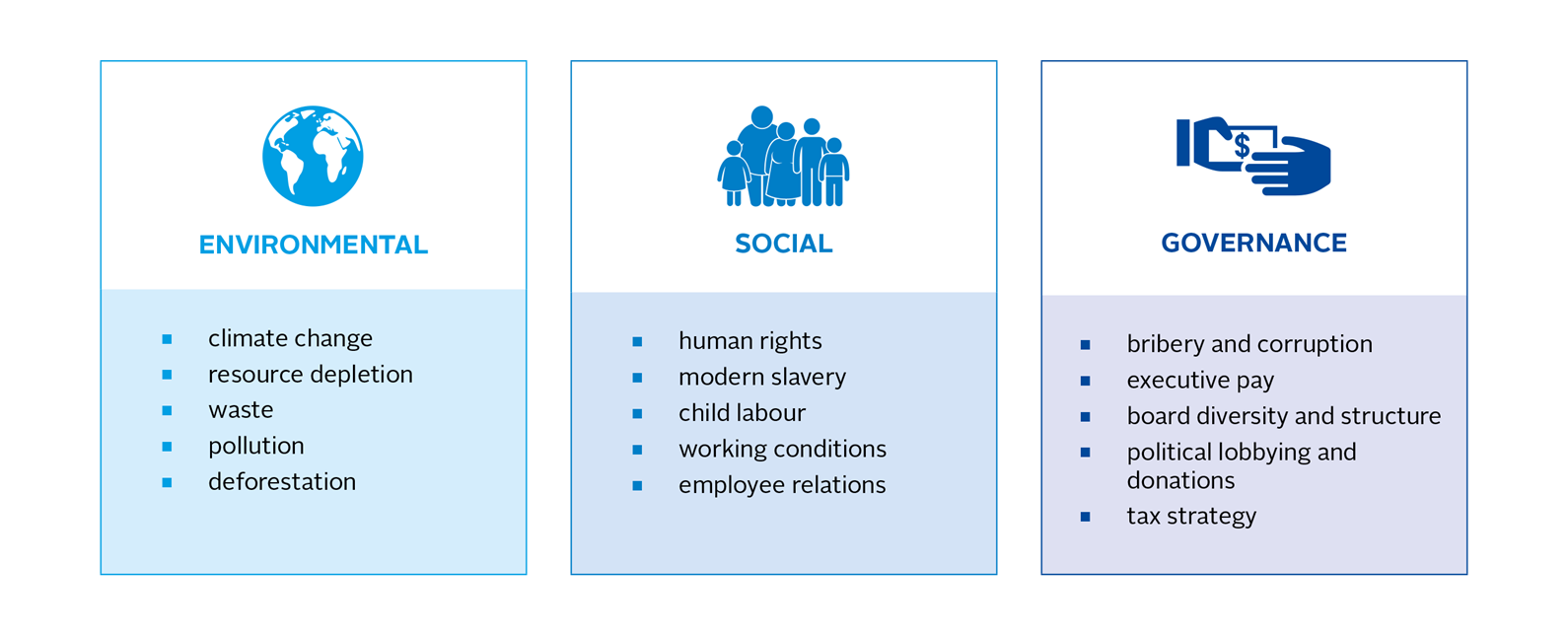

Fundamental Asset Management is committed to a range of Environmental, Social and Governance (ESG) principles which help us to operate and invest responsibly. Through these principles, we aim to positively impact our internal and external stakeholders and wider communities.

UN Sustainable Development Goals (SDGs)

The 17 UN Sustainable Development Goals were adopted by UN Member States in 2015, as part of the 2030 Agenda for Sustainable Development. We are committed to ensuring alignment with the SDGs, working towards ending poverty, protecting the planet and improving the lives and prospects of everyone, everywhere. The UN SDGs are central to ESG.

Principles for Responsible Investment

Fundamental Asset Management adheres to the Principles for Responsible Investment (‘PRI’), the world’s leading proponent of responsible investment.

As institutional investors, we have a duty to act in the best long-term interests of our beneficiaries. In this fiduciary role, we believe that ESG issues can affect the performance of investment portfolios (to varying degrees across companies, sectors, regions, asset classes and through time). We also recognise that applying these Principles may better align investors with broader objectives of society. Therefore, where consistent with our fiduciary responsibilities, and commensurate with our investment universe and resources, Fundamental Asset Management commits to the following:

- To incorporate ESG issues into investment analysis and decision-making processes;

- To be an active owner and to incorporate ESG issues into our ownership policies and practices;

- To seek appropriate disclosure on ESG issues by the entities in which we invest;

- We will continue to review our ESG principles to ensure these reflect the changing landscape.

In addition to our ESG principles, we abide by the Modern Slavery Act.