News & Insights

How will the General Election impact small caps?

If you are wondering how the results of the General Election will impact small caps, watch Fundamental Asset Management’s webinar on Tuesday 16th July at 3pm “False start or are small caps up and running?” Fundamental’s Chris Boxall, Stephen Drabwell and Jonathan Bramall will review the impact of the General Election result. They will also… Read more

Investor’s Champion Podcast

For forthright discussion on results and news from our portfolio companies and many other companies on AIM, tune into the weekly podcast from our associated investment news site, Investor’s Champion. Available on all major platforms or by clicking on one of the below links. Podcast Links Investor’s Champion Podcast Spotify Apple Amazon Music Additional Information… Read more

Early Birds Reap the ISA Rewards; The Early Investor Catches the Growth

Recent research has provided compelling evidence that within each tax year, early ISA (Individual Savings Account) investors significantly outperform those who invest in their ISA later in the tax year. THE POWER OF DAY ONE INVESTMENTS New data is clear; early investments in ISAs significantly outperform according to recent research from Hargreaves Lansdown. The research… Read more

The Professional Investor Podcast – episode 2

The Professional Investor is a podcast series which goes inside the mind of a UK based professional investor. It explores; the secrets of asset management, gives the inside scoop on the latest developments from the front line of the investment industry as well as analysis and opinion on what is going on in the economy…. Read more

The Professional Investor Podcast

The Professional Investor is a new podcast series which goes inside the mind of a UK based professional investor. It explores; the secrets of asset management, gives the inside scoop on the latest developments from the front line of the investment industry as well as analysis and opinion on what is going on in the… Read more

Why a Bed and ISA transfer to Fundamental could be just the ticket

With ISA season 2024 upon us and people looking to do more with their money; a “Bed and ISA” could be just the ticket. We look at what it is and how it can help with Inheritance Tax (IHT) Planning. A Bed and ISA transfer is a process in which a client moves their non-ISA… Read more

Inheritance Tax – another record smashed

ANOTHER RECORD The latest data on tax receipts from HMRC shows that Inheritance Tax (IHT) receipts for April 2023 to December 2023 of £5.7 billion were £0.4 billion higher than in the same period a year earlier. The 7.5% increase means the Treasury is on course to take record receipts of about £7.6 billion from IHT… Read more

Autumn Statement and Inheritance Tax

Despite many articles in the press in the run-up to today’s Autumn Statement, Inheritance Tax (IHT) was neither scrapped nor were thresholds changed. With figures this week showing that the Treasury is on course to secure a record IHT take this year; if you want to save your family money on IHT when you pass… Read more

Inheritance Tax Up, Stamp Duty Down

The latest data released by HMRC shows receipts for Inheritance Tax (IHT) has gone up while Stamp Duty receipts have declined. For the period of April 2023 to September 2023, IHT receipts have surged to £3.9 billion, marking a £400 million increase from the same period last year. This rise can be attributed to the… Read more

HMRC today announced another record Inheritance Tax haul

HMRC today announced Inheritance Tax (IHT) receipts are £300 million higher than the same period a year earlier, totaling £3.2 billion. With the government freezing IHT thresholds until at least April 2028, this trend looks set to continue. Commenting on the HMRC figures, Fundamental Asset Management’s Chris Boxall said: “HMRC has once again announced a… Read more

The AIM ISA – 10 years and counting!

It’s 10 years since ISAs were allowed to hold AIM shares for the first time. So how has AIM changed over this time and why was the change in ISA rules so relevant for AIM? A significant moment in the history of AIM The change in ISA rules on 5th August 2013 to allow ISAs… Read more

AIM company valuations the most attractive we have seen

It’s been a torrid time for the AIM market for around 2 years now, with the AIM index down just under 40% in that time. Yet things are far better than you might expect and what the declining share prices imply, if you know which companies to look at. We have assessed 39 AIM stocks, representing… Read more

Another month, another rise in Inheritance Tax receipts for HMRC

INHERITANCE TAX RECEIPTS UP HMRC data released this morning show Inheritance Tax (IHT) receipts reached £600 million in April 2023, which is £100 million higher compared to the previous tax year’s April figures. Commenting on the rise, Jonathan Bramall, Business Development Manager at Fundamental Asset Management said: “Due to years of increasing house prices, high… Read more

How to keep Jeremy Hunt’s hands off your family’s money

With today’s HMRC announcement that Inheritance Tax (IHT) Receipts are up £1billion to £7.1bn, Fundamental Asset Management give some tips for keeping the money you want to leave your family out of the Chancellor Jeremy Hunt’s hands. Fundamental’s portfolio manager, Chris Boxall explained: “Using AIM for IHT is the easy, non-contentious way of getting IHT… Read more

Fundamental Asset Management’s Chris Boxall interviewed by Fund Your Retirement

For their latest podcast, the investment research and online financial media publisher Fund Your Retirement have interviewed Chris Boxall, co-founder and portfolio manager at Fundamental Asset Management. In a broad ranging interview, linked below; Chris gives his view on the AIM market, singles out two companies he views as having high growth prospects and looks… Read more

HMRC Inheritance Tax receipts up again

Inheritance Tax (IHT) receipts were up again April 2022 to February 2023. Compared to the same period in the previous year, there was an increase of £0.9bn with a total of £6.4bn being received. This serves as a timely reminder of the ISA Deadline for clients who wish to deposit new or additional funds with… Read more

AIM for Growth or Income: can you have both?

When investing in smaller quoted companies and particularly those on AIM, the predominant investor focus is of capital growth, as opposed to dividend income. Indeed, the London Stock Exchange’s description of AIM as being a “Market for small and medium size growth companies” highlights the junior market’s primary purpose. While our firm would never advocate… Read more

WEBINAR: What does 2023 have in store for AIM?

Join Fundamental Asset Management’s Co-Founders Chris Boxall & Stephen Drabwell on Tuesday 31st January at 3pm as they look at the risks and opportunities for AIM in 2023. They will review 2022 and look into their crystal ball for 2023. What happened to AIM in terms of its size and overall performance? The webinar is… Read more

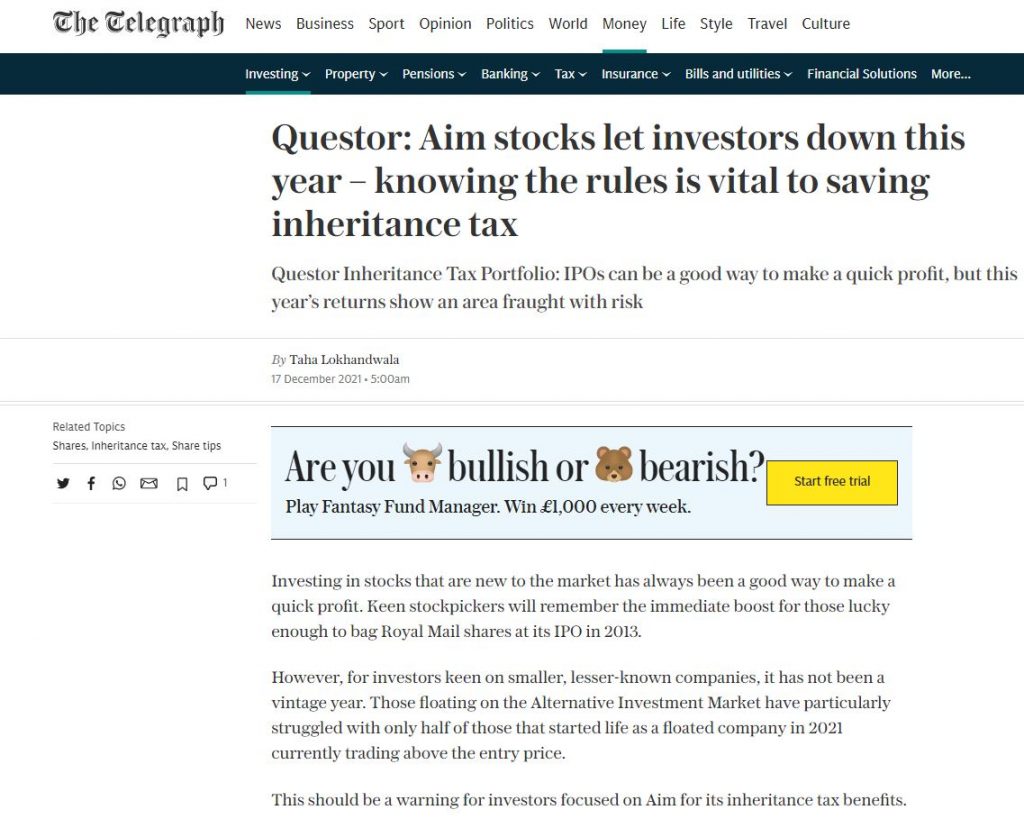

Fundamental features in the Telegraph

As the provider of the best performing stock tip of 2022, a rare positive in a horrid year for AIM and client portfolios, the Telegraph’s Questor column once again turned to Chris Boxall, portfolio manager at Fundamental Asset Management, for their Questor AIM IHT share tip for 2023. The latest request coincides with the launch… Read more

AIM dividend yields highest we have seen

The AIM Dividend Monitor from Link Group suggests the total dividend payout from AIM companies will reach £1.22bn in 2022, which will be close to the record payout of £1.29 billion in 2019. Our assessment suggests that dividend payments may actually exceed this level. Rising dividend yields The strong rebound in dividend payments has coincided with a… Read more

Video interview – AIM IHT for income

In this video interview, Chris Boxall, co-founder of AIM specialist investment manager Fundamental Asset Management, discusses the opportunities for income investors in AIM IHT ISA portfolios. With AIM companies set to pay out just over £1.2 billion in dividends in 2022 there are plenty of high yielding AIM stocks to choose from, although prospective investors… Read more

AIM IHT portfolios for INCOME? Is it worth it?

AIM isn’t a market that’s generally considered for its dividend and income attractions, and we have always expressed caution on AIM companies paying out high dividends, when they should be putting their cash to better use. However, the steep decline in share prices of many good-quality AIM companies has seen dividend yields soar to levels… Read more

Fear vs greed

It has been a painful time for AIM investors across the board. Fundamental Asset Management portfolio managers have been giving their thoughts and insights into where the market is, how we got here and where it might be going. In addition, in a recent interview with Jeremy Naylor on IGTV, co-Managing Director Chris Boxall talks… Read more

Storms continue to batter global markets

Global Markets Continue to Struggle The outlook for global economies continues to look challenging, with high inflation and rising interest rates potentially tipping many countries into recession. As a result, global stock markets, led as usual by the US, have been suffering for quite a while. Unfortunately AIM has not been immune to this, with… Read more

Webinar – AIM: cheap for good reason or bargains to be snapped up?

Is it time to be greedy when others are fearful? It has been a painful time recently for AIM investors. In the upcoming Fundamental Asset Management webinar on Wednesday 12th October at 3pm we ask: AIM: cheap for good reason or bargains to be snapped up? To register your spot and to be able to watch it after the event,… Read more

Kwasi’s bold Budget – what does it mean for AIM?

UK chancellor Kwasi Kwarteng’s mini-Budget, ‘The Growth Plan 2022’, which is intended to give a much-needed boost to the British economy, should be good news for smaller growth companies, particularly those on AIM, although you wouldn’t believe it from the stock market’s initial reaction to the news! Kwarteng announced a “new approach for a new… Read more

Weak pound means opportunity for AIM’s exporters

The pound is trading near its lowest level against the US dollar since 1985, a year which also saw Mikhail Gorbachev become the leader of the Soviet Union, Boris Becker become the youngest winner of the Wimbledon Men’s singles title and England win the Ashes. The popular press is revelling in the current gloomy economic… Read more

Inflation proofed returns from AIM

Since arriving on AIM in 2011 at 60p per share (currently 930p) and a market capitalisation of only £50m (currently £1.25 billion), Glasgow headquartered Smart Metering Systems (‘SMS’) has evolved into a fully integrated energy infrastructure company. SMS is a long-term holding in Fundamental Asset Management’s AIM IHT portfolios. The global energy market has changed rapidly… Read more

Will your money help HMRC break another record?

Will your money help HMRC break another record? HMRC’s latest figures released today show that Inheritance Tax (IHT) receipts for April 2022 to July 2022 are £2.4 billion; £0.3 billion higher than in the same period a year earlier. Will your family have to pay IHT to HMRC after you have passed on? If this is something you… Read more

Sustainability a priority for this AIM IHT portfolio company

Brickability Group (AIM: BRCK), the AIM quoted construction materials distributor and one of our AIM IHT portfolio companies, recently announced fabulous results for the year ended 31 March 2022. Brickability is a leading construction materials distributor, serving customers across the UK and Europe for over 36 years through its national and local networks. The Group… Read more

AIM for positive impact: Jet2 leads the way

The recent full year results statement from AIM listed leisure travel group Jet2 PLC (AIM:JET2) made a point of highlighting its focus on sustainability. While a company operating a fleet of passenger airlines is unlikely to draw huge amounts of enthusiasm from ESG investors, Jet2 appears to be making considerable progress on the sustainability front…. Read more

AIM – Q2 review – what has gone wrong and what are the opportunities?

Watch our webinar where we consider AIM in second quarter of 2022 – what are the opportunities? Where and why did things go wrong and when will things get back on track? Join Fundamental Asset Management’s co-Founders Chris Boxall & Stephen Drabwell on Wednesday 20th July at 2pm as they look at what happened to AIM in the… Read more

AIM for Positive Impact

In our last blog – which can be read here; we announced that Fundamental Asset Management is now a signatory to the Principles for Responsible Investment. In further recognition of the growing importance of Environmental, Social and Governance (ESG) issues, we are producing a series of Blogs titled ‘AIM for Positive Impact’ highlighting the initiatives being made by our AIM… Read more

Fundamental has signed the Principles for Responsible Investment

Fundamental Asset Management is committed to a range of Environmental, Social and Governance (ESG) principles which help us to operate and invest responsibly. In support of this we have recently become a signatory of the Principles for Responsible Investment (‘PRI’), the world’s leading proponent of responsible investment. The PRI encourages investors to use responsible investment… Read more

No initial fee for advised clients investing Direct

No initial fee for advised clients who invest Direct To further support advisers, from Monday 27th June, advised clients who directly invest in Fundamental Asset Management’s AIM IHT Portfolio Service will no longer be charged an initial fee. The scrapping of any initial fee is part of our ongoing commitment to support advisers and aligns with our fee structure… Read more

The Fundamentals #9 – Our Investment Approach

In the ninth of our series – The Fundamentals – about going back to the basics of investing in AIM shares for Inheritance Tax (IHT) planning purposes, we look at the Fundamental Asset Management investment approach. The Fundamental Asset Management investment approach is best described as, stock specific and growth focused, with a value overlay. Key criteria include: IHT qualification (current and… Read more

The Fundamentals #8 – A profile of our investment team

In the eighth of our series – The Fundamentals – about going back to the basics of investing in AIM shares for Inheritance Tax (IHT) planning purposes, we look at the Fundamental Asset Management Investment Team. Since 2004, Fundamental Asset Management portfolios have been managed by our two founders Chris Boxall and Stephen Drabwell. Chris and Stephen are experienced investment managers who have… Read more

The Fundamentals #7 – 10 reasons to invest with Fundamental Asset Management

In the seventh of our series – The Fundamentals – about going back to the basics of investing in AIM shares for Inheritance Tax (IHT) planning purposes, we look at reasons to invest with Fundamental Asset Management. If you or your client already invests with us, we hope you don’t mind us reminding you what makes us different. 10 Reasons to… Read more

AIM ‘For Sale’ – private equity spots a bargain

The recent stock market sell-off has resulted in several private equity groups taking a close interest in AIM quoted companies. We aren’t surprised given the quality on offer from AIM’s proven performers, nearly all of which are now trading at significantly lower valuations than they were a few months ago. At the end of April,… Read more

The Fundamentals #6 – How long do you need to hold a qualifying stock for it to receive IHT relief?

In the sixth of our series – The Fundamentals – about going back to the basics of investing in AIM shares for Inheritance Tax (IHT) planning purposes, we look at How long do you need to hold a qualifying stock for it to receive IHT relief? We recently ran a webinar for financial advisers where we answered questions on How to use AIM… Read more

The Fundamentals #5 – How to use AIM to stop HMRC taking money from your family?

In the fifth of our series – The Fundamentals – about going back to the basics of investing in AIM shares for Inheritance Tax (IHT) planning purposes, we look at: How to use AIM to stop HMRC taking money from your family. Figures released yesterday by HMRC showed they took £6.1 billion in Inheritance Tax for March – up by £0.7 billion… Read more

The Fundamentals #4 – What is the Fundamental AIM Inheritance Tax Portfolio?

In the fourth of our series – The Fundamentals – about going back to the basics of investing in AIM shares for Inheritance Tax (IHT) planning purposes, we look at: the Fundamental AIM Inheritance Tax ISA Portfolio. Inheritance Tax planning is not only for those with high net worth. It is a tax which is paid in record numbers (HMRC figures released… Read more

The Fundamentals #3 – The perils of exit fees & support for a client’s estate

In the third of our series – The Fundamentals – about going back to the basics of investing in AIM shares for Inheritance Tax (IHT) planning purposes, we look at: the perils of exit fees & support for a client’s estate. Perils of exit fees When someone decides to invest, one of the last things they think about is; ‘what are… Read more

ISA deadline reminder

The ISA deadline for 2021/22 is April 5th, the tax year end. However, the latest date for receipt of ISA applications is 31st March. Please contact us if you would like to discuss opening an AIM IHT ISA. You have until the deadline to invest this year’s £20,000 savings allowance so as to benefit from no tax on dividends,… Read more

The Fundamentals #2: How to use ISAs for Inheritance Tax (IHT) planning?

In the second of our new series about going back to the basics of investing in AIM shares for IHT planning purposes, we look at: How to use an AIM ISA to reduce Inheritance Tax. Are ISAs Inheritance Tax free? ISAs per se are not Inheritance Tax free, but they can become so by using a… Read more

Introducing The Fundamentals Series

Our last Blog here covered a stock market sell-off and what we are doing. This week we are doing things a bit differently. Recently, we have received requests to go over some topics from the beginning to assist people who are trying understand what we do at Fundamental Asset Management as well as what AIM… Read more

AIM market sell-off – what we are doing

The week is closing with another big stock market sell-off and, as is once again the case, the shares of smaller companies, particularly those on AIM, are having a tougher time than the blue chips. Russia’s diabolical invasion of Ukraine has further destabilised a fragile stock market, which was already straining under inflationary and interest… Read more

Russia invades Ukraine and stocks tumble – what does it mean for the portfolios?

Attributed to Nathan Mayer Rothschild during the Napoleonic wars, it’s pertinent to consider the above statement at the current time as Russia invades Ukraine and stock markets plunge – at the time of writing the UK stock market is down 3%. But how have wars really affected stock markets? Research from LPL Financial indicates that… Read more

Volatility brings Opportunity to AIM IHT planning investors

Equities in general continue to be weak and volatile as investors weighed mostly positive US earnings reports against the threat of rising interest rates. Last week, the BoE’s monetary policy committee voted to increase the base interest rate by 25 basis points to 0.5%. This marked the first back-to-back rate hike since 2004 and came… Read more

Inheritance Tax receipts are rising – there is a simple solution

Figures released by HMRC in 2021 showed that Inheritance Tax (‘IHT’) receipts reached £4.1 billion between April and November 2021, around £600 million more than the same period in 2020 – that’s tax being paid on wealth, that has already been taxed before! Following his March Budget, Chancellor Rishi Sunak also chose to freeze the… Read more

Fundamental Asset Management in The Telegraph

2021 is proving to be the first year since 2014 that Initial public Offerings (‘IPOs’) on London’s AIM market have exceeded cancellations, although our research, which was picked up by The Telegraph’s Questor column, indicates that it’s proved hard for IPO investors to make money investing in AIM’s new arrivals. You can download the Telegraph… Read more

Fundamental AIM IHT portfolio update

Since hitting a high at the beginning of September, when its valuation touched £150 billion, the AIM market has struggled to make any progress, with the latest discovery of a new Covid-19 variant also pushing stocks lower across the board. Some of AIM’s larger and more richly valued companies have been particularly weak over recent… Read more

Did you know? AIM shares can be held in ISA and on platform…

With tax allowances frozen by The Chancellor at the last Spring Statement and rising inflation there has been an increase in the number of people finding themselves with an inheritance tax issue. This is also affecting financial advisers who are spending more of their time helping clients with their Inheritance Tax planning to navigate this… Read more

AIM- a market full of opportunity

At the end of September 2021 there were 835 companies on AIM, with the total market value of London’s growth market £149 billion. This compares to 836 companies at the end of August 2021, when AIM’s market value was also £152 billion. September also saw a reduction in the number of AIM companies valued at… Read more

Investors flock to AIM for Inheritance Tax planning

According to The Openwork Partnership, one of the UK’s largest networks of financial advisers, there was a 38% spike in demand for advice on Inheritance Tax (IHT) planning in the past year, with more than one in ten clients wanting to discuss it. This demand is set to increase significantly with latest data from HMRC… Read more

AIM shares can help cut your Inheritance Tax bill

Business Property Relief (BPR) is a valuable tool which can be used to help you reduce your Inheritance Tax bill. In a nutshell, if you hold a BPR qualifying asset for two years and until death then that asset will be exempt when calculating how much of your estate will be liable to Inheritance Tax… Read more

What is the reason for the increase in IPOs on AIM?

AIM, is one of the London Stock Exchange’s great success stories. However, back in 2008 the London’s growth market began to see a decline in the number of new listings. This was a direct result of the financial crisis and the global uncertainty that followed. Given the nature of AIM, there will always be companies… Read more

Is AIM outperformance set to continue?

AIM has been the envy of growth markets around the world for some time now. It significantly outperformed London’s main market in all key areas during the Covid-19 crisis and has also significantly outperformed over the past 5 years. The make-up of AIM has changed considerably since it began back in 1995 when it was… Read more

Is your ISA at risk of a 40% Inheritance Tax charge?

If you are one of those people who have been saving into an ISA throughout your working life, then you are most likely to be in the fortunate position of having grown this investment into a significant asset. Investing into an ISA was a good move as it offers you tax-free growth and income on… Read more

IHT receipts up a staggering 54% for April and May compared to the same period in 2020

Inheritance Tax (IHT) receipts were up an incredible 54% for April and May compared to the same period in 2020. Good news for the Chancellor, bad news for those looking to reduce IHT! These figures are according to data published in a recent HM Revenue & Customs bulletin. The report confirms that full-year IHT receipts… Read more

More AIM Success- but what are the drivers of return?

AIM continues to be the market of choice and the envy of growth markets around the world. It has comfortably outperformed London’s main market in all key areas during the Covid-19 crisis so far, one of the worst periods of economic uncertainty and downturn in our economic history. But where has its success derived? The… Read more

Sold a business in the last 3 years and now with an Inheritance Tax issue?

Shares in a business which qualify for Business Property Relief (BPR) can benefit from 100% Inheritance Tax mitigation if held for two years and until death. Many businesses in the UK qualify for this relief and many businesses rely on this exemption to pass their family-owned business down to children or other beneficiaries, free of… Read more

Fundamental Asset AIM for positive & sustainable growth- Explained!

Fundamental Asset Management was recently featured in What Investment after our decision to broaden our investment mandate and introduce positive & sustainable growth into our AIM IHT portfolio. (Read the full article here). There are two improvements this brings. Firstly, it widens our remit and therefore our opportunity for growth. And secondly, it allows us… Read more

Fundamental Asset Management introduce positive & sustainable growth into AIM IHT portfolios

Read the What Investment coverage of Fundamental Asset Management’s recent decision to broadening its investment mandate and introduce positive & sustainable growth into its AIM IHT portfolio. (Read the full article here) Chris Boxall, co-founder & co-managing director at Fundamental Asset has said: “this is an inevitable evolution of our successful AIM for IHT portfolio… Read more

FTSE main market still struggling to keep pace with AIM!

Against all apparent and previously established logic London’s AIM market for smaller growing companies has comfortably outperformed London’s main market in all key areas during the Covid-19 period so far, one of the worst periods of economic uncertainty and downturn in our economic history. The AIM All-Share index rose 26% between the end of January… Read more

Should I Transfer my ISA?

It is not long until the end of this tax year. This is always a good time to sit down and assess your financial situation and evaluate your existing ISAs. Many people consider switching their ISA provider due to poor performance or a lack of expert guidance and switches often occur towards the end of… Read more

The Spring Budget- what does it mean for Inheritance Tax?

The Chancellor of the Exchequer Rishi Sunak recently delivered his spring Budget setting out the Government’s plans for taxation and spending for the upcoming financial year. This contained several important measures aimed at restoring control of public finances gradually and to tackle the ongoing challenges brought about by the coronavirus pandemic. But what does it… Read more

What drove AIM’s outstanding performance in 2020…

London’s AIM market had a remarkable 2020, ending the year with its market value at an all-time high and with the AIM Index also significantly outperforming other UK main market indices. But what drove this remarkable performance in such a challenging year? AIM (formerly known as the Alternative Investment Market) closed 2020 with 819 companies… Read more

How does AIM Contribute to the UK Economy?

In 2019, AIM companies contributed £33.5 billion to UK GDP, directly supporting more than 430,000 jobs and contributing £3.2 billion in tax revenue. Over the last 5 years the direct economic contribution made by AIM companies has grown by 35% from £24.8 billion while employment has grown by 22%. In addition to this, direct contribution… Read more

AIM is for growth not just tax relief

Investing in well-established AIM listed companies has delivered significant outperformance relative to the UK main market, and indeed other international stock markets, over recent years. The AIM index finished 2020 up 20% for the year, an amazing achievement in the circumstances, significantly outperforming the main UK index of 100 stocks which fell 15%. This represented… Read more

Use it or lose it!

Individual Savings Accounts (ISAs) were launched in 1999 and have become one of the most popular saving tools for investors at all stages of investing whether saving for a first home or for retirement. 11.2 million adults subscribed to ISAs in 2018-19, up from 10.1 million the year before (Source: HM Revenue & Customs). So… Read more

How can my clients benefit from AIM?

AIM has helped many growing small and medium size companies in the UK gain access to public markets and the benefits that this brings to their businesses. AIM also provides a platform for the start-ups and small businesses of today to grow into the large businesses of tomorrow, benefitting the wider UK economy. Individual investors… Read more

AIM on platform.. why wouldn’t you?

Last year’s unwelcome introduction of Covid into our everyday lives saw several trends and behaviours emerge. Family solicitors are seeing a significant increase in requests for will writing. And financial advice is no different, with financial advisers seeing an increase in demand for Inheritance Tax Planning (IHT) solutions. Historically, IHT solutions had only been available… Read more

AIM is fast maturing into a grown-up stock market

An article in the Daily Telegraph’s popular Questor column commented on the encouraging evidence of AIM’s centre of gravity tilting away from the ‘get-the-founders-rich-quick outfits’ towards real, well-run businesses with bright prospects. Telegraph subscribers can read the article here, alternatively, Yahoo! Finance has also kindly provided a free to read version here. AIM’s fabulous performance… Read more

AIM market value hits all-time high

The latest monthly AIM update from our associates Investor’s Champion highlights the continuing strong performance of AIM, with the total value of London’s growth market hitting an all-time high of £118 billion at the end of November. November closed with 22 AIM companies valued at more than £1billion, three more than at the end of… Read more

Encouraging to see more ESG initiatives from AIM companies

We have been keeping a close eye on the reaction of AIM companies to the increasing ESG demands of customers and investors. This week brought news of initiatives from two AIM companies which highlight the growing focus on ESG from the AIM community. Science in Sport (LON: SIS), the premium performance nutrition company serving elite… Read more

AIM for Inheritance Tax planning is not early stage investing

Many are attracted to invest in AIM for the Inheritance Tax planning attractions yet are fearful of the perceived extra risk of investing in smaller quoted companies and the notion that they will have their money locked up in early stage businesses. While the vast majority of AIM companies are smaller than their peers on… Read more

Introducing our new Adviser Centre!

At Fundamental Asset, we understand the important role financial advisers play in helping clients make good financial decisions to achieve their goals. We feel it is our duty to support you in this which is why we have created our new Adviser Centre. Our Adviser Centre is designed to make your life easier and has… Read more

Sunak scraps the Budget – should AIM tax reliefs be enhanced?

The popular press had previously alluded to the potential withdrawal of Inheritance Tax/Business Relief on AIM shares. With Chancellor Sunak scrapping his autumn Budget, as he focuses on matters of more immediate concern to the economic welfare of the country, any adverse tax changes for holders of AIM shares therefore appear to be off the… Read more

Common AIM Myths Debunked!

AIM is often considered a higher risk market due to the increased volatility, but does heightened volatility really amount to greater risk? From our perspective the purest definition of risk is the likelihood of a permanent loss of capital and, over the last 10 years, AIM’s larger companies have been better at delivering capital growth… Read more

Watershed event for AIM

The proposed acquisition of main market listed SDL (LON:SDL) by AIM quoted RWS Holdings (LON:RWS) is, in our opinion, a watershed moment for AIM, as an AIM company acquires a sizeable main market listed peer, but the combined group reamins on AIM. RWS is one of the world’s leading language, intellectual property support services and… Read more

Did you know..

There were 830 companies listed on AIM at the end of July and approximately 70% qualified for the valuable Inheritance Tax reliefs. Fundamental Asset Management have been expertly running AIM for IHT portfolios for more than 16 years and have an in-depth understanding of the Inheritance Tax qualifying rules. Inheritance tax is the most hated tax… Read more

Good few weeks for our portfolio companies

Despite their obvious appeal and relevance in our lives, many UK investors surprisingly have little direct exposure in their portfolios to leading US technology groups, preferring instead to invest via a collective investment scheme. We find it surprising that while much of the UK population is happy to use Amazon, Google, Apple iPhones etc, it… Read more

In case you missed us..

Find out from our Co-founder Chris Boxall where the opportunities are in AIM and why this is a market you should be considering for growth and not just the Inheritance Tax planning benefits. Click anywhere on the picture below to take you straight to the recording. Derek McLay Fundamental Asset Management You can find… Read more

In case you ask..

Since the start of lockdown the unemployment rate in the UK remains relatively unchanged. So far so good. However, scratch the surface and a far more worrying picture begins to emerge. Figures from the Office for National Statistics showed that UK company payrolls fell by 649,000 between March and June, a 16.7% fall. The reason… Read more

Opportunities on AIM market after Covid-19?

There is no doubt that Covid-19 has changed the way we view our future. Investors and financial advisers alike are looking for the answers and the way to move forward. One thing we do know is that the show will go on regardless, Covid or non-Covid. In the headlines this week, Boohoo Group reacted to… Read more

Value of AIM to the UK economy significantly outweighs cost of modest tax concession

An excellent report from specialist growth company research house, Equity Development, has highlighted the huge benefits AIM brings to the UK economy and how the mild encouragement provided by the Inheritance Tax concession to those considering an IPO onto AIM is a very large multiple of the cost in tax foregone by HMRC. We would… Read more

What is driving AIM’s outperformance?

The AIM index is up 30% since 1st April i.e. Q2 2020. Maybe this is not surprising when you consider that it fell by 29% in Q1 and, as has been widely reported in the mainstream press, markets have rebounded. However, when you compare to the UK main markets, AIM has massively outperformed in Q2… Read more

As AIM celebrates its 25th birthday, are the tax reliefs at risk?

A recent article in the popular press has alluded to the potential withdrawal of Inheritance Tax/Business Relief on AIM shares. As a well-established investor in AIM for Inheritance Tax (‘IHT’) planning purposes, we have become used to regular press mutterings over the 16 years we have been managing our AIM for IHT portfolios. The introduction… Read more

Health-care diagnostics are the pick of the week

Shares in high flying ITM Power (LON: ITM), the energy storage and clean fuel company, had an interesting week after announcing a distinctly underwhelming year end trading update. It is quite staggering how a business with real annual sales revenue of only £3m can now be valued at over £1bn. There is clearly a huge… Read more

Airlines stocks continue their recovery and quality continues to shine

Wizz Air Holdings (LON:WIZZ), the largest low-cost airline in Central and Eastern Europe, announced fantastic results for the year to 31 March 2020. Despite the challenging environment WIZZ is committing to the purchase of plenty of new aircraft over the next few years and has also announced its first ever flights from London Luton to… Read more

Markets need to pause

With many stocks bouncing strongly over the past few weeks, you could be forgiven for thinking that the world was back to normal, coronavirus a minor concern and a recession firmly off the cards….if only! The FTSE100 index and its constituents of aged dinosaurs has risen 23% from the March lows, the S&P500 index has… Read more

A big week for fund raises on AIM

It was a big week for fund raises across AIM with one of our AIM portfolio constituents receiving strong support from its shareholders sending the shares significantly higher. Fundamental AIM portfolio constituent Watkin Jones (LON:WJG), the developer with a focus on the Build to Rent and student accommodation sectors, reported strong results for the 6… Read more

News of a big dividend hike for one of our AIM portfolio companies

Fundamental AIM portfolio constituent, Jarvis Securities, announced a 69% increase in its second quarterly interim dividend to 11p, reflecting continuing strong trading for the stock broker as it benefits from the volatile environment. While the full year forecast dividend remains unchanged at 30p, equating to a yield of more than 5%, the suggestions are that… Read more

Fundamental’s technology giants continue to shine

Having bounced strongly off lows, we are somewhat reassured that stock markets closed the week in more sceptical territory with some semblance of a return to normality as trade tensions between the US and China resurfaced, if one calls that normality. It was a big week of earnings announcements from the major technology groups, several… Read more

Encouraging news from AIM

While the prior week closed with stock markets buoyed by promising news of a potential Covid-19 treatment from Gilead Sciences (US: GILD) this week was different story, with trial results casting doubt on the effectiveness of its drug remdesivir. The quest to find a test, treatment or vaccine for coronavirus is certainly heating up. Academics… Read more

News from a single company lifts global stock markets

As another turbulent week came to a close, stock markets were lifted by news that a drug developed by US listed biopharma group Gilead Sciences (US: GILD) may be showing promise as a Covid-19 treatment. Of 125 patients recruited by the University of Chicago for Phase 3 Trials taking Gilead’s drug remdesivir, of which 113… Read more

Encouraging news from the week

Bioventix (LON:BVXP), the developer of high-affinity monoclonal antibodies for applications in clinical diagnostics, announced excellent interim results for the six months ending 31 December 2019. Revenue rose 21% to £5.3m and pre-tax profit was up 31% to £4.3m. The operating cash inflow was £4m boosting period end cash to £5.5m. Bioventix isn’t facing quite as… Read more

Bear Market or Bull Market?

Despite falling on the last day of the week, stock markets (notably the US) still registered decent gains, boosted by the huge $2Trillion package of support signed off by the House of Representatives. A manic rally during the week saw the US market climb more than 20% in 3 days, the best 3 day run… Read more

Dividends at risk: apply some cash flow common sense

During these testing times the dividend yield can often prove illusory. While many companies are well-placed to continue supporting their dividends, many others, burdened by high levels of debt and declining cash flow, will be struggling to support the cash payments with short term survival sadly the primary focus. Faced with a meaningful decline in… Read more

Why are Markets so Volatile?

An excellent article today in the Wall Street Journal ‘Why Are Markets So Volatile? It’s Not Just the Coronavirus’ commented how the stock market is now dominated by computer-driven investors that rely on signals such as volatility and momentum Since the mid-February market peak, the Dow Industrials have closed more than 1,000 points lower on… Read more

Coronavirus encourages stock markets to take a breather

The indiscriminate sell-off in global equities due to the spread of the coronavirus has, not surprisingly, resulted in material weakness across Fundamental portfolios in the current quarter. As is usual in these circumstances, the selling has been indiscriminate and even companies considered traditional safe havens have seen their share prices fall. Smaller companies as always… Read more

Why are UK investors reluctant buyers of US listed shares?

We are puzzled why many UK investors appear reluctant to acquire shares in some of the best known companies in the world, preferring to delegate responsibility to some mediocre fund manager via a collective investment vehicle, which often has hundreds of holdings, many of which are also mediocre. The US stock market’s considerable outperformance of… Read more

Fundamental’s elephants are galloping fast

It’s been a big week of announcements from many of our portfolio holdings and some our large cap companies are putting their smaller peers to shame, delivering stupendous growth. As the world’s largest online payments provider with the fastest growing mobile platform, Fundamental Ultimate Stocks Portfolio holding PayPal Holdings (US: PYPL) was bound to benefit…. Read more

AIM stocks rally on Conservative landslide

The Conservative election victory, supported by progress with the US/China trade negotiations, triggered a strong rally from stock markets, with the UK index of 100 leading shares up just over 1%, the UK mid-cap index surging over 3% and US stocks hitting record highs. The AIM index was up just over 2%, but who were… Read more

AIM, where patience brings big rewards

The share price of CVS Group (LON:CVSG), the UK’s leading veterinary services business, rose strongly this week on the back of another positive trading update. CVS has been a mainstay of Fundamental AIM portfolios for many years, although it’s tested our patience on numerous occasions. The dynamics of the UK veterinary market have changed significantly… Read more

Invest in what you know – know what you invest in

The nature of investing in AIM for Inheritance Tax planning purposes is that investors must directly hold shares in the underlying AIM companies, albeit via a broker’s nominee arrangement. The Inheritance Tax planning benefits would be lost should investment be made via a fund or investment trust arrangement where the investor simply holds shares or… Read more

AIM – the Good, the Bad and the Ugly

Investing in the shares of qualifying AIM companies can attract 100% relief from inheritance tax and is a proven tax planning method, avoiding the costs associated with a trust, or the risks associated with gifts. It’s also been a rather good investment strategy to follow, as long as you know what you are doing! Fundamental… Read more

Crowdfunding continues to thrive, but the valuations look crazy – better value on AIM?

The latest news that leading UK based crowdfunding platform Seedrs raised a further £4.5m in a new funding round has highlighted the appeal of rapidly growing, early stage companies to UK investors, at least relative to the duller offerings on the UK stock market. However, while there is no doubting the growth appeal of early… Read more

Office of Tax Simplification Inheritance Tax Review – second report: what does it really mean for AIM?

The Office of Tax Simplification (‘OTS’) published its long-awaited review on reforming Inheritance Tax. A first report released in November 2018 dealt with the administration of estates while the latest report focuses on how Inheritance Tax could be made “easier to understand and more intuitive and simpler to operate”. The stand-out headlines in the latest report… Read more

Jeremy Corbyn’s ‘Land for the Many’ and Inheritance Tax relief on AIM shares

An independent report commissioned by the Labour party entitled ‘Land for the Many’ proposes, among other interesting suggestions, to replace the current system of Inheritance Tax with a “lifetime gifts tax” levied on the recipient of the gifts. The proposals give rise to obvious fears that children will be taxed for financial assistance given to… Read more

With yet another set of fantastic results AB Dynamics has become a poster child for AIM and small cap investing in general

AB Dynamics (LON:ABDP), the manufacturer of advanced testing systems to the global automotive sector, has issued yet another set of fantastic interim results. Our earlier Blog from April 2016 commented how this terrific little business had delivered consistent excellence since arriving on AIM in 2013, highlighting the potential to uncover some brilliant businesses on the… Read more

Quartix (QTX) – timely, clear reporting from this cracking AIM company

In a recent podcast with our associates Investor’s Champion, Chris Boxall of Fundamental Asset Management discussed some of the problems with company reporting, notably with reference to UK banks, and and why clear, easy-to-read financial statements, with a minimum of adjustments, can be good for your investment portfolio. In this regard, full year results from AIM quoted… Read more

Inheritance Tax bill cut by 12%, or £710m, through investing in unlisted companies including AIM – record high

A new report from national accountancy group UHY Hacker Young highlights the tax saving benefits of investing in AIM quoted companies – there are considerable investment benefits as well! According to UHY Hacker Young, HMRC forecasts show that the value of “Business Property Relief” is expected to rise 8% in 2017/18, from £655m in 2016/17. Taxpayers… Read more

The key to AIM success

Chris Boxall, co-founder of AIM specialist Fundamental Asset Management, writes in this week’s Investors Chronicle. The article ‘The key to Aim success’ suggests how the AIM Admission Document should be essential reading for any investor in AIM companies, yet large parts of this vital document are often ignored. The disastrous performance of Conviviality (CVR) and… Read more

Client money can stay ‘on platform’ with Fundamental AIM for IHT planning portfolios

The improving quality of companies on AIM, combined with the Individual Savings Account (ISA) rule changes from August 2013 which allowed AIM shares to be held within ISAs, has seen a growing number of investors consider AIM for both its investment and tax planning attractions. The ability to invest in inheritance tax (IHT) qualifying portfolios… Read more

Do we really know what we are investing in? Time to reconnect with our investments

The latest investment fund offering from a company called Source, whose web site prattles on about something called Smart Beta, only serves to highlight to us the growing disconnect between investors and their investments. An investment maxim, followed by most of the great investors, was to always ‘invest in what you know’. Unfortunately, in today’s… Read more

Flawless performance on AIM from this lovely business offers a great guide of what to look for from a micro-cap

A manufacturer of advanced testing systems to the global automotive industry has just delivered yet another set of fabulous results. While many seem intent on criticising AIM for its looser regulation (and ‘occasional’ problem case) this little business has delivered consistent excellence since arriving on AIM in 2013, with little fanfare I should add. It… Read more