Jeremy Corbyn’s ‘Land for the Many’ and Inheritance Tax relief on AIM shares

An independent report commissioned by the Labour party entitled ‘Land for the Many’ proposes, among other interesting suggestions, to replace the current system of Inheritance Tax with a “lifetime gifts tax” levied on the recipient of the gifts. The proposals give rise to obvious fears that children will be taxed for financial assistance given to them during their lifetimes, including assistance to buy a home, as well as facing higher levies on inheritances.

Under the proposed system, a Corbyn led government would levy a tax on the gifts received above a lifetime allowance of £125,000. When this lifetime limit is reached, any income from gifts would be taxed annually at the same rate as income derived from labour under the income tax schedule.

The Resolution Foundation estimate that taxing gifts through the income tax system would raise £15 billion in 2020/21, £9.2 billion more than the current inheritance tax system, and would do so more progressively.

Under the proposal outlined by the Institute of Public Policy Research (‘IPPR’) there would be conditional exemptions for business and agricultural property, under which tax could be deferred until the asset is sold or until the business ceases to be a trading entity and becomes an investment entity. This would allow families to maintain the integrity of agricultural land or business assets.

There are clear grounds for the proposed tax system to continue supporting Business Relief, which underpins the long-term investment in small trading businesses, the lifeblood of the UK economy.

Many shares listed on AIM, the London Stock Exchange’s market for smaller growing companies, qualify for Business Relief purposes. UK individuals have reaped the rewards of patient long term investment in smaller innovative companies on AIM, many of which have grown into sizeable businesses. Fundamental Asset Management’s Blog has highlighted AIM success stories and also draw attention to the occasional failure.

While the short 2-year qualifying period encourages investment in AIM as a tax planning tool, we would urge investors to consider the longer-term investment benefits.

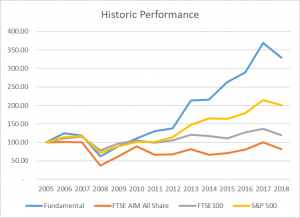

Our patient, long-term approach has seen our AIM for inheritance-tax planning portfolios materially outperform leading stock market indices over the 15 years we have been investing in AIM.

Performance of Fundamental AIM portfolios (blue line) vs leading stock market indices

AIM remains a market for smaller investors, not large institutions, and a place where the individual can enjoy material investment outperformance and continue to support the UK economy.

Fundamental AIM portfolios can be accessed directly or via many leading wrap platforms, including Standard Life, Transact and Elevate.