Encouraging news from the week

Dividend commitments, a rare thing

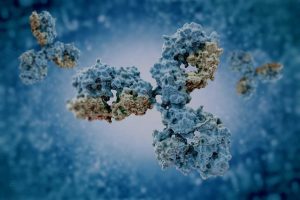

Bioventix (LON:BVXP), the developer of high-affinity monoclonal antibodies for applications in clinical diagnostics, announced excellent interim results for the six months ending 31 December 2019. Revenue rose 21% to £5.3m and pre-tax profit was up 31% to £4.3m. The operating cash inflow was £4m boosting period end cash to £5.5m.

Bioventix isn’t facing quite as many challenges as others companies during the coronavirus lockdown. Healthcare products and services are priority products, with diagnostics among the most crucial. Management therefore expects its customers will continue to operate and Bioventix will continue to supply antibodies to them.

It’s also one of the few companies in the current climate able to commit to their dividend, with a 20% increase in the proposed interim to 36p.

Fundamental AIM for Inheritance Tax planning portfolios hold shares in Bioventix

While operating in totally different sectors, Bioventix joins Sage Group (LON:SGE) and Microsoft (US: MSFT), both Fundamental portfolio companies, as one of the more resilient companies on the stock market in the face of the current crisis.

Manufacturer of commercial floor coverings, James Halstead (LON:JHD), announced record 1st half results and, as a preferred supplier to the health service, its products continue to be in high demand.

For the 6 months ending 31 December 2019 sales rose 3.7% to £130.4m, pre-tax profit was up 2.8% to £25.2m and basic earnings per share increased 4.1% to 9.5p. The operating cash inflow of £28.4m boosted period end cash to £64.3m, just what’s needed going into the current crisis.

The group contemplated long and hard about the payment of its dividend. Approximately half their UK workforce and around 60% of former employees (who are now pensioners) are shareholders and rely on the dividend for income. Accordingly, they have decided to declare a first interim dividend of 2.125p per share, representing half of the interim dividend they would otherwise have declared. They will subsequently review the payment of a second interim dividend in August when visibility of the global economy may be clearer.

Who would have thought that flooring would have demonstrated such defensive properties. James Halstead is a long-term holding of Fundamental AIM portfolios.

Argentex Group (LON:AGFX), the provider of foreign exchange services to institutions, corporates and high net worth private individuals has kept a relatively low profile since listing in June 2019 but it continues to deliver on the significant promise. Fundamental AIM portfolios have started acquiring a satellite position in Argentex.

The latest trading update covering the 12 months to 31 March 2020 highlighted a strong performance, with revenue up over 30% to c.£29m and management confident of meeting full year profit expectations.

Somewhat surprisingly, there was no mention of material impact from the current crisis, other than continued strong performance. Non-Executive Director Henry Beckwith was an enthusiastic buyer of shares earlier in March and holds a 6.5% stake.

It appears to be almost business as usual for surgical and advanced woundcare specialist Advanced Medical Solutions Group (LON: AMS).

With £65m of cash in the bank and no debt at 31 December 2019, AMS is in robust financial condition. Furthermore, in the unlikely event that it’s needed, there is also an undrawn unsecured £80m credit facility. AMS is committing to a final dividend for 2019 of 1.05p per share, which will cost approx. £2.25m.

AMS is another long-term core holding of Fundamental AIM portfolios.

Moneysupermarket.com (LON:MONY) reported 2% overall growth in revenue for the first quarter ending 31 March 2020 with insurance related revenue leading the way, growing 8%, while other areas saw reduced activity.

Diversified revenue streams, strong cash conversion and net cash of £30m at 31 March means the group is able to commit to the final dividend of 8.6p per share, which will cost £46m and equates to a yield of 2.93% at the current share price of 293p.

While other, previously admired, online groups like Rightmove (LON:RMV) and Auto Trader (LON:AUTO) have been found wanting in the current exceptional environment, MONY continues to deliver, although that hasn’t stopped the shares falling 30% from the July 2019 highs.

Pets at Home Group (LON: PETS), the UK’s leading pet care business issued an encouraging update for its financial year ending 26 March 2020, with full-year underlying pre-tax profit now anticipated to be slightly ahead of expectations following exceptional levels of demand, both in-store and online, in the last few weeks of the financial year as customers stocked up.

While the group carries substantial debt (net debt was £539m at 30 Oct 2019), unlike many retail businesses, its designation by the UK Government as an “essential retailer” means business continues and cash continues to flow.

PETS is also generously helping communities with £1.1m of funding to nominated pet charities, a £1m crisis fund for colleagues and discounts to NHS workers.

While revenue will clearly be impacted over the coming months, PETS is in a better position than many retailers and, as a result, the shares have held up better than most.

CMC Markets (LON:CMCX),the online derivative and stockbroking trading platform, issued a very positive update for the year ending 31 March 2020.

If, as is likely, stock markets remain volatile CMC will continue to reap the rewards, that’s assuming its clients don’t suffer too many losses!

The supportive environment and CMC’s strong balance sheet means that it will be able to commit to a dividend equivalent to 50% of profits after tax. Consensus forecasts for the March 2020 year were for a dividend payment of 14.43p per share, equivalent to a yield of 7% at the current share price, however, this might now be on the low side given the very strong final quarter.

While stock markets have tumbled, CMC shares have proven to be an excellent contrarian investment, rising 35% over the past 3 months.

To keep up to date with the coronavirus impact on these and many other companies please visit our associates Investor’s Champion