The week is closing with another big stock market sell-off and, as is once again the case, the shares of smaller companies, particularly those on AIM, are having a tougher time than the blue chips.

Russia’s diabolical invasion of Ukraine has further destabilised a fragile stock market, which was already straining under inflationary and interest rate fears; ironically, in the short term, the risk of the latter has now diminished.

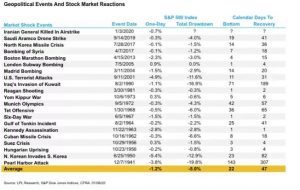

Our previous Blog here shows the stock market reaction to major geopolitical events going back to the Pearl Harbor Attack of 1941.

Mr Market, the manic depressive!

As experienced investors in AIM for Inheritance Tax planning purposes for nearly 20 years, we have unfortunately seen this all before, most recently at the time of the first pandemic lockdown in February 2020 when stock markets fell precipitously, with the AIM market falling 36% in a month. Following this tumultuous and very rapid fall it proceeded to recover strongly, finishing the year up 20% and eclipsing the main UK stock market which remained lower. A similar recovery took place after the financial crisis with the AIM index more than doubling off lows.

Moving forward to the current time, AIM IHT portfolios, in line with the AIM index, are down c20% year-to-date and 25% down from the highs hit at the beginning of September 2021, while the UK main market is down approximately 9.5%.

Selling on AIM has been indiscriminate this week, with even mild disappointment severely punished, and large share price declines for some stocks, as high as 60% in a day in some cases. It should be emphasised that there are rarely stock specific reasons for such dramatic falls, and this is simply the feature of a less liquid market, with plenty of irrational sellers and very few buyers. With a few exceptions, such dramatic share price declines rarely reflect the financial strength or long-term prospects of the companies in question, they are simply a feature of ‘Mr Market’s’ irrational behaviour.

So, what do we do at times like these?

The simple answer is, very little, other than keep an eye out for bargains.

There is certainly no point manically trading, seeking out potential safe havens as they don’t exist, with all small caps being dragged lower, notwithstanding any apparent defensive characteristics. The bid/offer spread also widens and it’s a lot harder to sell at the desired price.

Panic selling, on Mr Market’s terms rather than your own, is always the wrong approach. This incurs unnecessary trading costs and one risks being out of the market when things turn around, as they surely will at some point.

During periods of excessive volatility we recommend clients ignore the manic movements of share prices as they are largely irrelevant, that is unless you need to sell, which we hope is not the case. Think of smaller companies on the stock market as one would an unquoted private equity investment, which does not have the distraction of daily pricing.

Furthermore, as investors in AIM for Inheritance Tax planning purposes, we don’t have the luxury (or disadvantage) of being able to sit in cash and are obliged to remain fully invested, so there is nowhere to hide, even if we wanted to. The advantage of this is that when things do turn around, which they will, portfolios are well placed to benefit, being already invested.

What about valuations?

Companies which joined in AIM in 2021, often with unwarranted valuations, have seen their shares hit particularly hard, with little loyalty being shown by new shareholders. The valuations of many of these were unjustified, often based on unusual market conditions over the pandemic which flattered their growth prospects. Many institutions were naïve to back these at such high valuations and they are now paying the price. The artificial valuations assigned to IPOs, which are priced by brokers and the companies themselves, is a reason why we are reluctant investors at IPO and like to see companies deliver on public markets first.

The valuations of some better-established AIM companies have looked stretched for a while and if growth prospects are determined to be less stellar than originally anticipated (something experienced with one of our stocks this week) share price falls are justified, however, not to the extent that we have seen, as Mr Market’s pessimism becomes excessive.

Conversely, the valuations of some excellent highly profitable companies, with attractive growth prospects, have also been pulled down to extremely attractive levels, offering compelling buying opportunities.

To all-intents and purposes, at times like these, we consider that long-term holders of small cap shares should notionally consider the stock market to be closed, that is unless you are a buyer. With the war only in its first week, the volatility is likely to continue for a while longer.

Fundamental Asset Management

www.fundamentalasset.com